Payment service providers: the driving force behind e-commerce

- over 2 years ago

- 4 min read

Last week we published our first Industry report on payment service providers (PSPs) — a good reason to share a bit of background on PSPs and online payment methods with you. After all, they play a crucial role in the success of e-commerce.

E-commerce has fundamentally transformed the way people shop, and the pandemic has greatly accelerated this trend. When was the last time you bought something online? According to a global survey of internet users, 58% reported purchasing a product or service online in the previous week (Commerce 2022, GWI).

How payment service providers made online shopping easy

In the early stages of e-commerce — and still common today in some developing countries — businesses selling online had to rely on traditional payment methods like cash on pick-up, bank transfers, checks or money orders, which were often slow and cumbersome. The first e-commerce transaction took place in the early 1990s, although accounts differ on whether the purchased product was a Sting CD or a pepperoni and mushroom pizza from Pizza Hut. As online shopping became more popular, a growing need for faster and more convenient payment options emerged. In 1998 PayPal was founded and launched its platform to transfer money only a year later. Since then, the number of payment platforms has mushroomed, and sellers today can choose from a vast variety of PSPs.

Payment providers offer a payment gateway, which is the technology that facilitates the transfer of money between a buyer and a seller. Payment gateways are generally integrated with various payment methods, including credit cards, debit cards and online payment systems like PayPal. This means that customers can use their preferred payment method to make purchases, which makes an online store more accessible and attractive to a wider range of consumers.

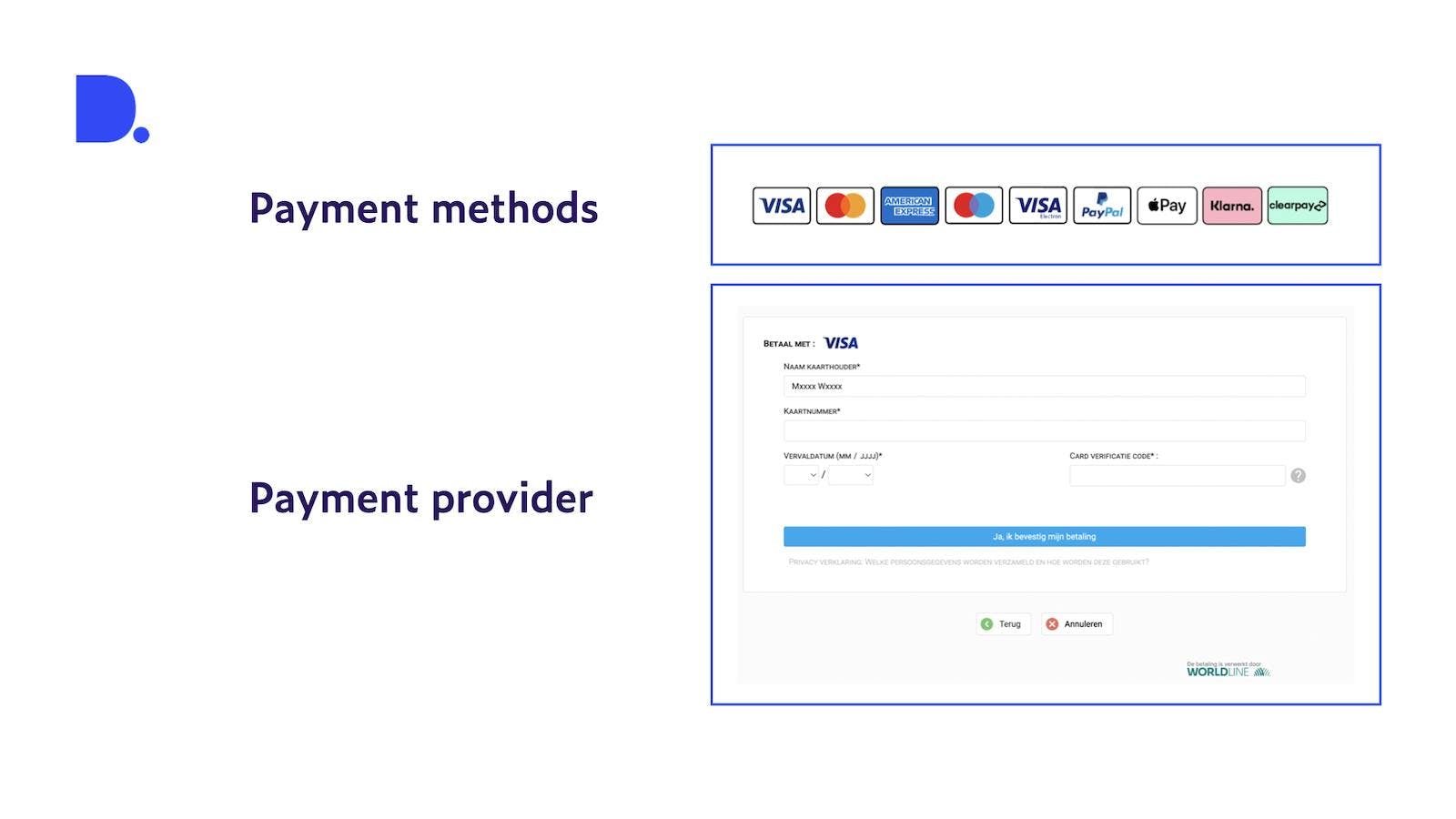

In Figure 1 (top section), you’ll see an example of available payment methods offered by an online shop. If you shop online regularly, this should be a familiar sight. It is very easy to spot the different payment options. What is a lot less common to see, however, is who is handling the payments. In the lower part of Figure 1, you can see an example of a Payment Service Provider (Worldline), which is a lot less noticeable than the payment methods. In most cases, consumers will not be aware of who handles the transactions. To find that information, consumers would have to scrutinize a website's privacy notice or terms and conditions. (e.g., here WorldPay is mentioned).

One platform with a range of payment options

PSPs play a critical role in e-commerce by providing secure and convenient payment processing solutions. Some charge a flat fee per transaction, while others charge a percentage of the transaction amount. A good payment platform offers a range of payment methods and integration options, making it easy for businesses to accept payments from local as well as international customers.

Payment service providers play a critical role in e-commerce by providing secure and convenient payment processing solutions.

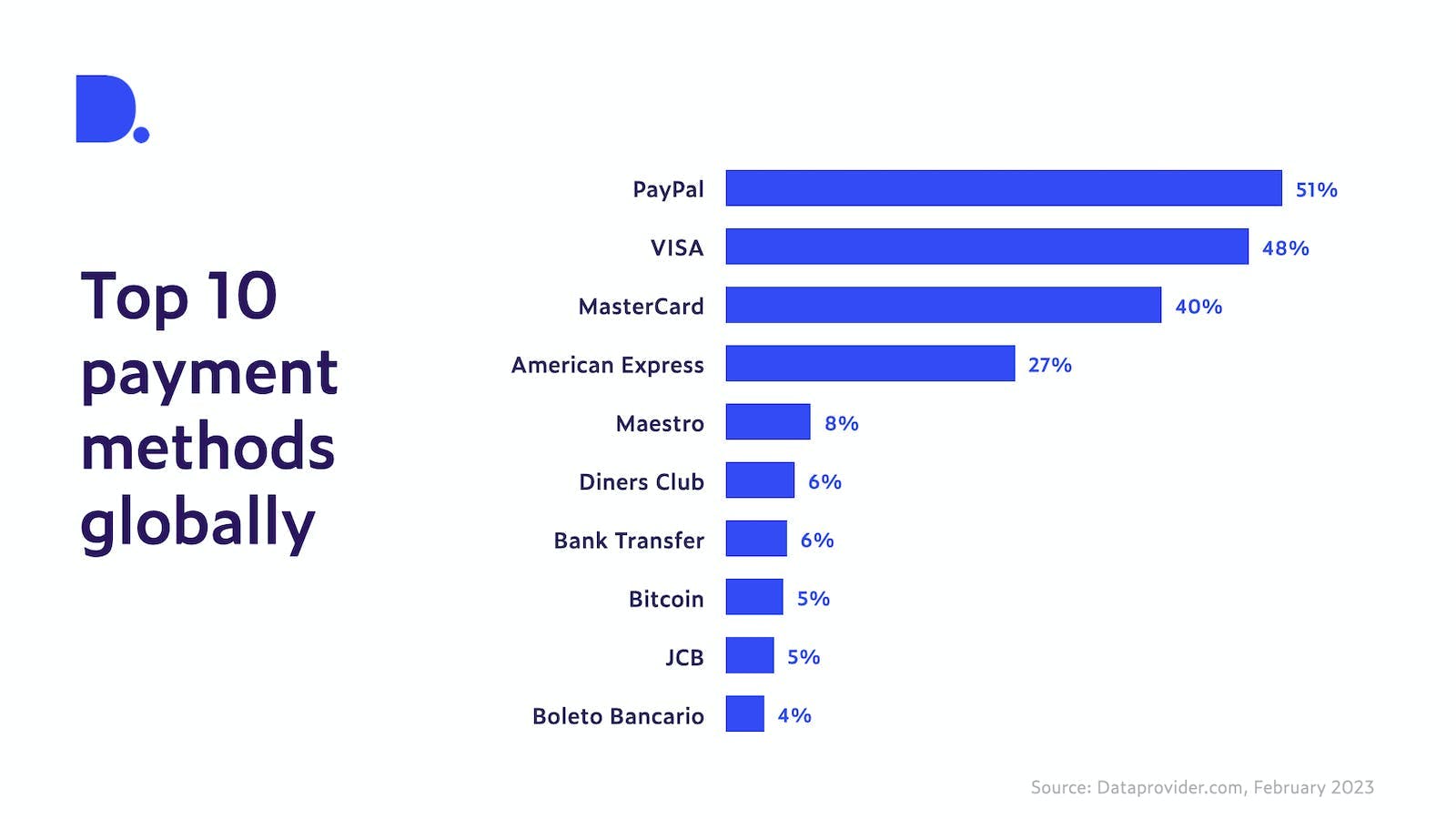

Some of the most common payment methods include credit and debit cards, e-wallets, mobile payments, bank transfers and more. While many of these payment methods are globally accepted, there are numerous local payment methods that are specific to a country or region. In Figure 2, we show the Top 10 payment methods based on their share among websites globally. As you can see, the majority are global brands, but in ninth place we encounter JCB, which stands for Japan Credit Bureau and refers to a Japanese credit card. The Brazilian Boleto Bancario, a voucher-based payment method, lands in tenth place.

One important thing to note is that sometimes a payment method can also be a provider. PayPal is a good example that is both a payment method and a payment provider with it’s own payment processing platform. If you look back at Figure 1, you’ll also see Klarna and Clearpay (Afterpay) among the accepted methods, but these two companies offer their own payment gateways and have become famous for providing Buy Now Pay Later (BNPL) services, which allow consumers to make purchases and pay for them in instalments over time, usually with no interest.

PayPal, Visa and Mastercard are dominant globally

Lastly, while there are local variations in payment methods overall, the dominant payment methods are the same across the world, with PayPal, Visa and Mastercard coming out on top in most regions. This is, however, quite different when we look at PSPs, where we see a lot more variation across regions and countries. In Figure 3, we show the top three payment providers based on share of websites by region.

Online payments have certainly come a long way since the early days of e-commerce, and they continue to evolve and adapt to the changing needs of businesses and consumers. With their secure and convenient payment processing solutions, value-added services, and advanced analytics tools, PSPs are an indispensable part of the e-commerce ecosystem.

Interested in a more in-depth look at PSPs? Download our Industry Report here and don't forget to join our webinar on leveraging web data for PSPs here.